Automation has been shown to help us control and monitor the production and delivery of various services; taking regular, repetitive tasks and performing them faster and more accurately. Automated marketing tools can send out designated messages, automated bank drafts and bill pays, perform APS retrieval, and more; the list will only keep growing as automation evolves. Business intelligence in applications is the newest form of high-quality automation.

Automation generally implies the integration of machines into a self-governing system that helps process commission statements with ease: calculating gross premiums for agent splits, and distributing back helpful reports to give you a bigger picture of current cash flows. It is no secret that the more time you have to analyze the available information, the better you’ll be able to make well-informed decisions. Many organizations are finding themselves stuck under a heavy blanket of commissions with different schedules and hierarchies, which means that they are losing the valuable ability to comprehensively look at the overall status of their organization.

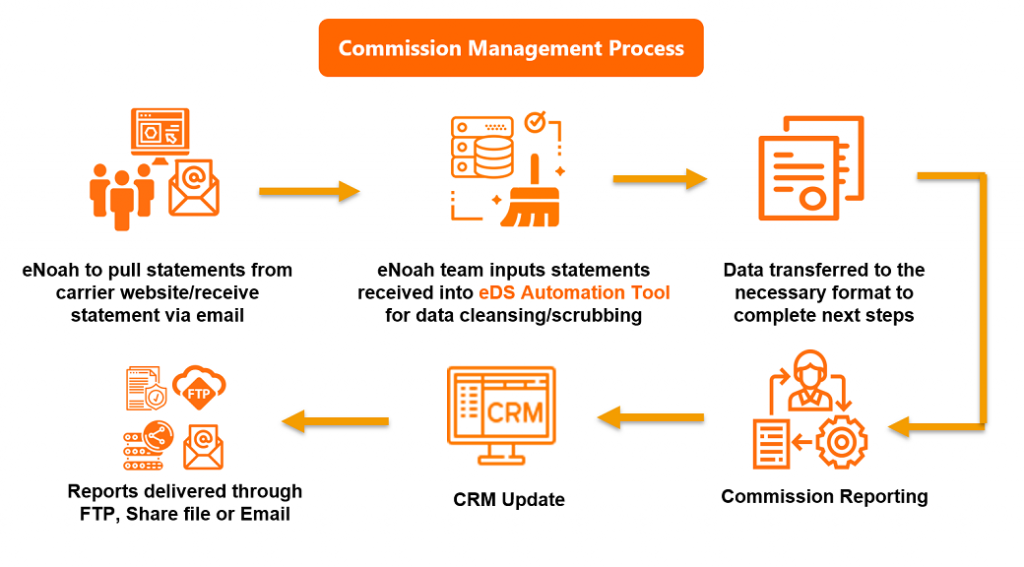

Automation in Insurance Commission Management Process

At eNoah, our expertise in Business Process Support has given us the ability to see the extensive structures that organizations have set in place to satisfy clients and insurance agents with their commission process. While each organization has different data that they consider it important to track, there is one thing that remains the same: all of it is manually processed. Moreover, carriers do not always set their commission processors up for success.

Most of the insurance carriers deliver in different formats, forcing the processors to copy over all the relevant commission data from a PDF/Excel to another format. As volumes grow, this leaves a great deal of room for human error and results in increasing turnover times for commission payouts – all of which leave agencies and agents with less time to devote to their core activities.

eNoah has designed a platform that reduces these frustrations, minimizing human error and improving average delivery times by up to 60%. Using form mapping and data analysis, eNoah has created a customizable commission tool that can deliver the desired data reports from each set of commission details. These details may be different for each organization: some want just the policy number, premiums, and commission amounts, while others may want all the information included in the commission statement. Regardless of the size and format of the data, technologically automating the commissions process minimizes human error, maximizes efficiency, and opens opportunities for growth by rapidly providing reliable and accurate data.