Case Management Services

Our team of insurance experts has over 25 years of experience in the field of case management. They work closely with clients to develop streamlined processes that meet clients’ unique needs without disrupting corporate culture. Their goal is to unlock value through faster time service, good customer experience, and the adoption of industry best practices.

We simplify the agency’s role by managing Life Insurance cases from submission to commission. Unconditional case follow-ups, constant touch-bases with insurance carriers’ case coordinators, better reviews by underwriters, and satisfactory premiums lead to quick case completion and a high placement ratio.

For inforce policies, we benefit insurance agents with premium reminders, grace period notifications, lapse follow-ups, conversion options, and surrender values.

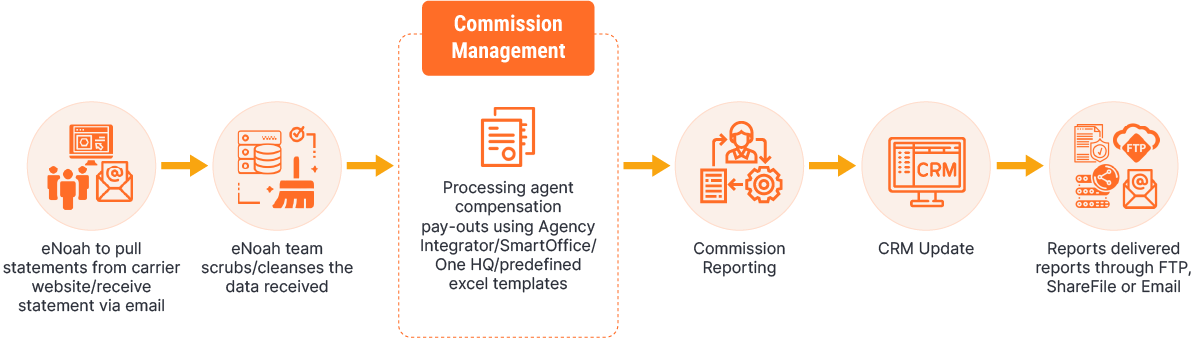

We also support brokerages by contracting agents with insurance carriers, commission reconciliations, reimbursement, and debt recovery.